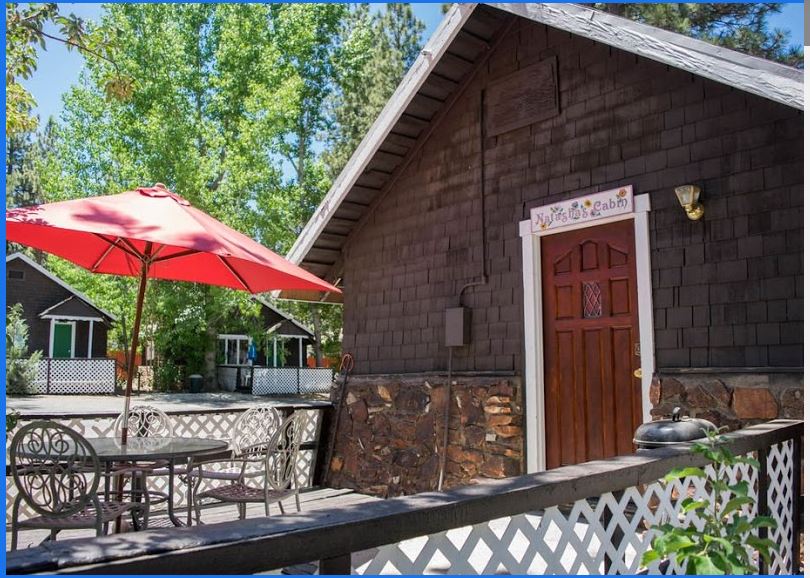

Huntington Beach, CA A client came to us looking to pull cash out on his lodge property in the Big Bear area of California. The funds were to be used for improvements to the property. The request was a challenging one due to the fact that the commercial real estate loan request was really more of a small business loan.

Commercial real estate loans for specialty use or single purpose properties require a deeper analysis. Unlike traditional commercial real estate loans against traditional properties like office, industrial, multifamily and retail properties, specialty use properties need to be analyzed beyond the loan to value and income of property. If a bowling alley closes down, for example, the is significant cost in changing in to something else of improving the location under new management. The lender has to not only be in the property at a conservation loan to value, but also has to buy in to the business being able to survive on a going forward basis.

“This place has been here for years! This is not a risky loan for the lender!”

This is something we hear quite often when being sold on securing funds for specialty or single purpose properties. Anyone remember Circuit City? They were forced to close their doors and are currently under a massive re-organization. Established in 1949, they enjoyed steady success through the 70’s, 80’s and 90’s before feeling the pain of consumer shift to online shopping and competitors entering the space. I have personally witnessed McDonald’s locations closing! The point is that anything can happen with business purpose commercial real estate, no matter how large or how small the operation is.

What additional analysis is required?

Some of the points to consider with these property types are the following:

- market demand for property

- competition in the surrounding area

- obsolescence of amenities or attraction (how many kids go to the arcade nowadays?)

- quality of management

- customer experience (in today’s world a bad Yelp review could have damaging impacts)

- landscaping and overall desirability of the property

This is not a complete list, but covers some key points to be considered when financing these property types.

If you have a challenging loan request, we would like to hear from you!

To your success!

Patrick Zazueta

Huntington Coast Capital, Inc.

714-719-8966

Contact Us 844-239-2632

Contact Us 844-239-2632